Historical Value and Prestige

Throughout history, pink diamonds have held a special place of honor, adorning the crowns of monarchs and gracing the most exclusive jewelry collections. Notable examples include the legendary “Pink Star” and the iconic “Darya-ye Noor,” both revered for their exquisite beauty and historical significance. Beyond their monetary value, pink diamonds symbolize luxury, elegance, and enduring prestige, making them highly coveted by collectors and connoisseurs alike.

Financial Performance and Stability

Investing in pink diamonds offers not only a chance to own a piece of history but also a potential for financial gain and stability. Over the years, pink diamonds have demonstrated resilience in the face of economic downturns, with prices often holding steady or appreciating even during periods of market volatility. As tangible assets, pink diamonds provide a hedge against inflation and currency fluctuations, offering investors a tangible store of value with the potential for long-term growth.

Growing Demand and Limited Supply

Driven by increasing global demand and dwindling supply, pink diamonds have emerged as one of the most sought-after investment assets in recent years. With major mining operations such as the Argyle mine in Australia ceasing production, the supply of natural pink diamonds has become increasingly scarce, further fueling their allure and investment potential. As collectors and investors scramble to secure these rare gems, prices are expected to continue rising, making pink diamonds an attractive investment opportunity.

Portfolio Diversification

In today’s uncertain economic climate, diversifying one’s investment portfolio is more important than ever. Pink diamonds offer a unique opportunity to diversify away from traditional asset classes such as stocks and bonds, providing investors with a tangible, portable asset that can help mitigate risk and enhance overall portfolio performance. By adding pink diamonds to their investment mix, investors can achieve greater balance and resilience against market fluctuations, thereby safeguarding their wealth for the future.

Tangible and Portable Assets

Unlike paper assets or digital currencies, why invest pink diamonds, tangible assets that can be held, touched, and admired. Their compact size and high value-to-weight ratio make them easy to store, transport, and liquidate when needed, providing investors with a level of flexibility and security that other investments may lack. Whether stored in a secure vault or worn as a stunning piece of jewelry, pink diamonds offer investors a tangible means of preserving and growing their wealth for generations to come.

Potential for Capital Appreciation

With their limited supply and growing demand, pink diamonds have the potential to appreciate significantly in value over time. Factors such as color saturation, clarity, and carat weight can all influence the price of pink diamonds, with rare, high-quality stones commanding premium prices in the market. As global wealth continues to increase and interest in luxury goods surges, the demand for pink diamonds is expected to rise, driving prices higher and offering investors the opportunity for substantial capital appreciation.

Intrinsic Beauty and Emotional Appeal

Beyond their investment potential, pink diamonds possess an intrinsic beauty and emotional appeal that transcends monetary value. From their exquisite color to their dazzling brilliance, pink diamonds evoke a sense of wonder and admiration that few other assets can match. Whether worn as a symbol of love and commitment or displayed as a rare and precious treasure, pink diamonds bring joy and delight to those who own them, making them a truly priceless addition to any collection.

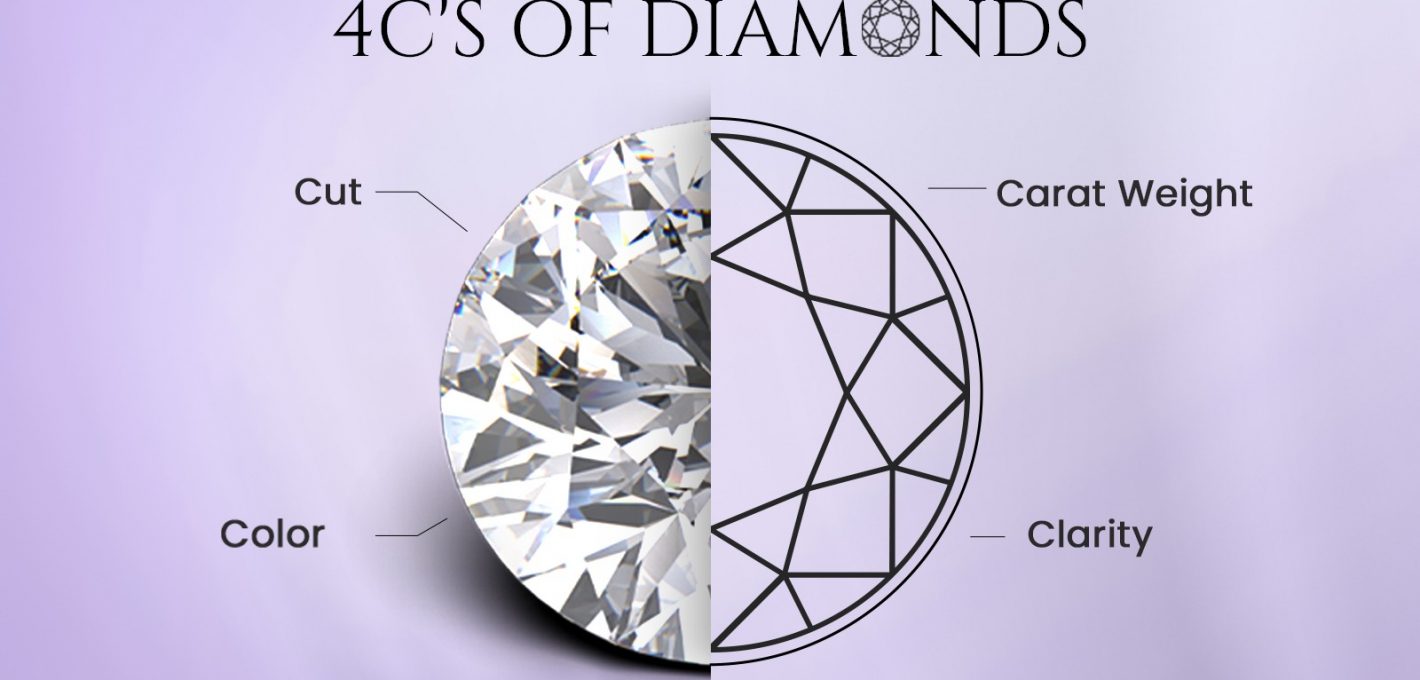

Factors Influencing Pink Diamond Prices

Several factors can influence the price of pink diamonds, including their color saturation, hue, clarity, and cut quality. Stones with intense, vivid hues and minimal inclusions are typically more valuable than those with lighter colors or visible flaws. Additionally, the size and carat weight of pink diamonds can also impact their price, with larger stones commanding higher premiums in the market. As investors evaluate potential purchases, it’s essential to consider these factors carefully and seek guidance from experienced gemologists and industry experts to ensure they make informed decisions.

Expert Advice and Due Diligence

Investing in pink diamonds requires careful research, due diligence, and expert guidance to navigate the complexities of the market successfully. Consulting with reputable gemologists, dealers, and investment advisors can help investors identify high-quality stones, assess market trends, and develop sound investment strategies tailored to their unique goals and risk tolerance. By partnering with knowledgeable professionals and conducting thorough research, investors can minimize risks and maximize their chances of success in the pink diamond market.

Sustainability and Ethical Considerations

In addition to financial considerations, ethical and sustainability factors are increasingly important considerations for investors in today’s socially conscious world. Supporting responsible mining practices and ethical sourcing initiatives is essential to ensure the long-term sustainability of the pink diamond industry and protect the environment and local communities where diamonds are mined. By investing in ethically sourced pink diamonds and supporting initiatives that promote transparency and accountability in the supply chain, man made diamonds,investors can make a positive impact while also securing their financial future.

Potential Risks and Challenges

While pink diamonds offer significant investment potential, it’s essential to recognize that they also come with risks and challenges that investors must be aware of. Market fluctuations, speculation, and changes in consumer preferences can all impact the value of pink diamonds, potentially leading to losses for investors. Illiquidity and limited resale options are also factors to consider, as it may take time to find a buyer willing to pay the desired price for a pink diamond. Additionally, the risk of encountering counterfeit or treated diamonds underscores the importance of conducting thorough due diligence and purchasing from reputable sources.

Conclusion

In conclusion, investing in pink diamonds offers a rare opportunity to own a piece of natural beauty and historical prestige while potentially generating significant financial returns. With their unique combination of rarity, beauty, and investment potential, pink diamonds stand out as an attractive alternative asset for investors seeking to diversify their portfolios and preserve wealth for the future. By carefully considering the factors outlined in this article and seeking expert guidance, investors can confidently enter the pink diamond market and reap the rewards of this timeless and captivating investment opportunity.